Analysis

Quicken Loans hopes in order to disturb the mortgage business making use of their the new Rocket Home loan. Understand what it is and how you can get a house financing within ten full minutes in our Rocket Home loan opinion.

Editor’s Notice

You can trust new ethics of your healthy, independent monetary advice. We could possibly, although not, discovered compensation on issuers of a few affairs stated within this blog post. Viewpoints is the author’s by yourself. This article was not provided by, analyzed, approved otherwise recommended from the any advertiser, unless or even indexed less than.

For many years, Quicken Loans have prided alone into as the greatest on the internet financial agent around. The effortless software procedure has actually helped it become among the biggest home loan companies on the market, bookkeeping to possess 6% of your own mortgages in the usa.

One to throws him or her directly behind financial giants such as for example Wells Fargo installment loans in Hamilton ND with bad credit and you can Pursue throughout the competition to deal with home loan share of the market. Pretty good getting a keen online agent.

Even after each of their profits, the newest Quicken Loans software procedure has never been a completely on line sense. Yes, potential individuals already been the applying processes on the internet. But as with any most other mortgage company, filed apps were given to help you a loan officer exactly who after that guided brand new applicant from techniques. That is how it features always has worked…so far.

Go into Skyrocket Mortgage, Quicken Loans’ treatment for the present day interest in totally online transactions. Today, financial candidates is romantic the entire application for the loan processes rather than actually being forced to correspond with various other real person. That is a fairly epic performing, and it could entirely alter the ways People in america get mortgages. In reality, Dan Gilbert creator off Quicken Money recently informed TechCrunch which he believes Rocket Mortgage could be a beneficial disruptor at home investment place the same as the way the new iphone 4 disrupted this new mobile phone industry. When taking a look at the tool, it’s hard not to ever trust their buzz.

Just how Rocket Mortgage Functions

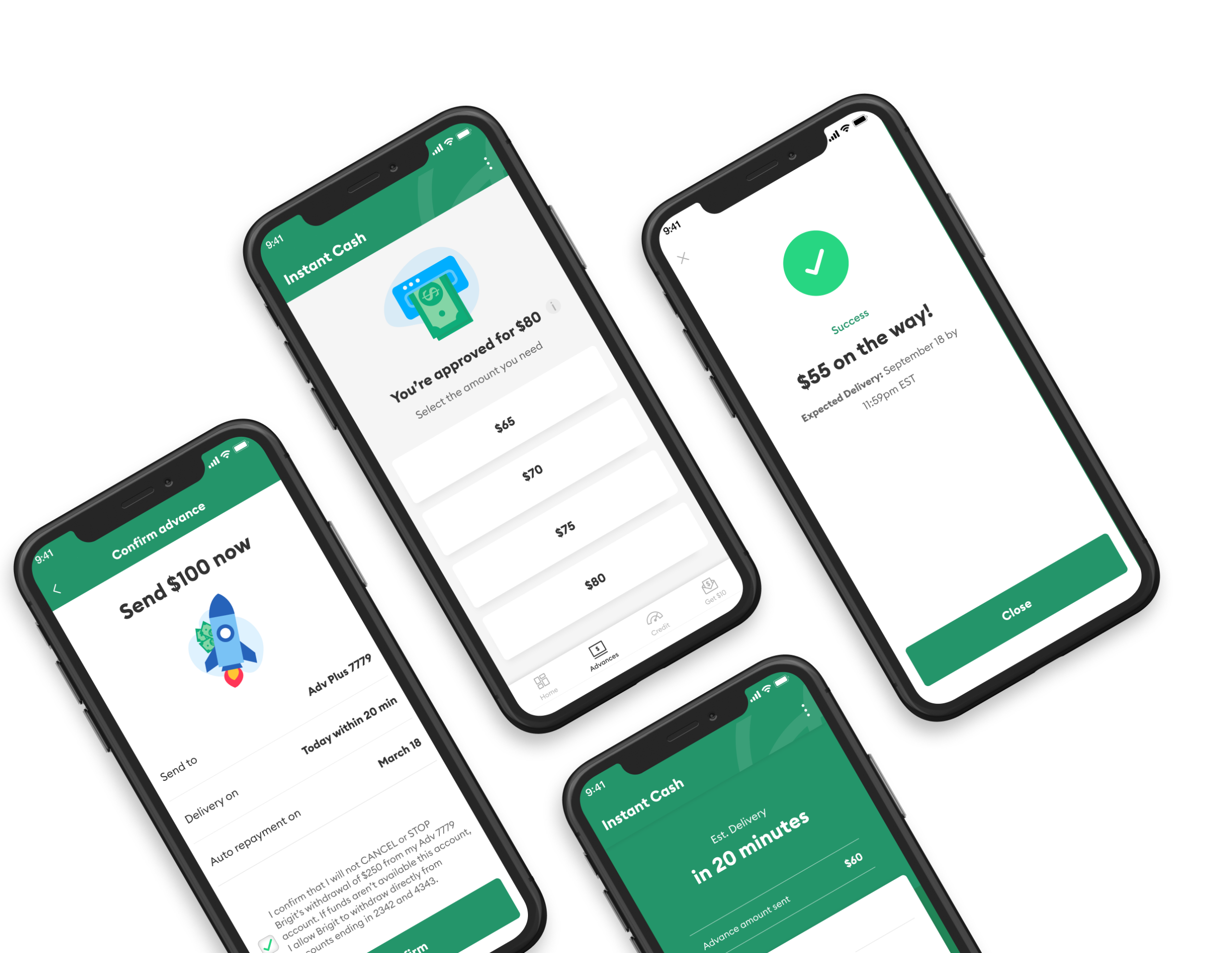

Rocket Home loan is changing the overall game to own mortgage software. They automates the fresh new verification procedure, getting rid of the need to upload all your valuable banking guidance so you’re able to a person being (usually many times). As someone who has applied for several new mortgages and you can refinanced a few others, I’m able to observe the fresh new processes was an enormous stress reliever and time saver. Seriously, I can’t believe that it’s pulled such a long time to possess a mortgage broker to visit so it station.

Immediate access for the bank info try impressive. But the primary feature off Rocket Financial is actually their element to help you accept the money at the lightning speed, reducing the fresh new waiting months with the debtor. Rocket Mortgage normally approve programs within just 10 minutes! That is incredible, and you will an enormous reason that this course of action can be hugely winning.

This new user interface is easy and you will easy, as it is the application procedure itself. Rather than simply tossing difficult to discover raw forms for the screen about how to complete, Skyrocket Financial allows you by the asking you a few questions. Your own remedies for those individuals concerns will determine how rest of the new interview goes. Like a modern tax system, Rocket Financial after that imports the answers to the best models.

The method initiate by the asking whether you are buying a house or refinancing a preexisting mortgage. Based on and therefore button you choose, the rest of the process try designed to complement you to objective. Credit regarding automated economic devices such as Individual Financial support and you may Improvement, Rocket Mortgage usually request you to connect your financial account so you’re able to the program. This permits them to look at the financial statements online rather than you being required to send him or her this new physical copies of one’s banking suggestions.

Immediately following typing every relevant guidance, you should use pick a whole real-time itemization of the charge, interest levels, and estimated percentage. Using a simple number of sliders, you can to switch the duration of your loan or buy activities to reduce your monthly obligations. When you find yourself happy with what you select, hit the fill out key to lock in your speed and you may upload your application out of to own instant approval.

Rocket Mortgage Benefits and drawbacks

Approval in minutes – Given that Rocket Financial asks you to link debt levels, you will get your loan acknowledged in minutes.

Real-time Openness – Shortly after finishing new survey, you’ll be able to observe to acquire facts otherwise changing this new term of financing make a difference the payment schedule due to actual-day pointers.

Personal In this weekly – The loan by way of Rocket Mortgage and you may Quicken Loans is also close in this per week, given third-people never reduce the procedure.

For up to its a bonus, lacking the ability to correspond with a human mortgage officer may potentially end up being a downside also. By the Doing it yourself characteristics off Rocket Home loan, people could possibly get miss out by applying having a home loan it is not fundamentally the best choice for their disease. Qualified applicants often have numerous mortgage solutions to them. Since most people are not financial experts, this really is one area in which a human financing administrator you are going to help direct its visitors on the best guidelines.

Does it Work?

Up until now, we can only assume how personal will answer Skyrocket Home loan. Just like the great things about the plan can be asked because of the some, some do-it-yourselfers is destined to make some costly mistakes. That is going to perform some really let down anyone, even when the blame is completely their own.

It’s possible one consumers will get determine which they need even more individual communications. Speaking of grand amounts of money our company is talking about here. But not, if you have ever taken out a mortgage, you have most likely prayed getting remaining by yourself by the home loan company will eventually for the techniques. Thus, my personal hunch would be the fact consumers are browsing think its great.

It is much too very early understand even in the event Quicken Loans’ grand enjoy towards the Rocket Home loan will pay from. Only go out will tell whether it it is inhibits the mortgage field as it is capable of doing. But, within this chronilogical age of broadening automation and you may demand for a great deal more customer handle, it appears as though Rocket Mortgage is a solid wager ahead out a champion.

Leave a reply